- Educação

- Estratégias de Negociação

- Estratégia de Negociação Alligator

Alligator Trading Strategy

Let's delve into another noteworthy indicator in our discussion — the Alligator. What makes this indicator intriguing is its ability to reveal the initiation of a trend movement. While it isn't typically employed as a primary indicator due to infrequent signals, its lines can serve effectively as support and resistance levels. The indicator's creator took a somewhat romantic approach in describing its functionality:

1) Alligator is sleeping — all lines are entwined and horizontally located. When the alligator is sleeping all its lines are entwined and horizontally positioned. This signals a flat market where the Alligator's jaw, teeth, and lips intersect. As a rule in technical analysis, the longer the Alligator remains in this dormant state, the more potent the subsequent price movement will be after a sideways trend or consolidation.

2) Alligator awakes — the indicator lines begin to widen. The alligator is hungry and starts hunting for the prices. When the distance between the lines becomes longer it means that the alligator opens its mouth. The direction where the alligator opens its mouth shows a trend direction.

3) Alligator is not hungry — the indicator lines move closer and its mouth is going to be shut. In such cases, the alligator doesn’t want to eat and is going to sleep and “digest” the price. The closure of the alligator's mouth signals the end of the current trend. It is advisable to close all active deals and await the next hunting phase of the alligator.

A signal of a stronger bearish tendency — the alligator’s mouth is opened

We receive a trading signal when the price chart breaches the slowest indicator line or the alligator's "jaw". To confirm the price direction, we look for the "closing of the mouth", which occurs when both the fast lines (lips and teeth) intersect the slowest line.

What to do when you see this signal:

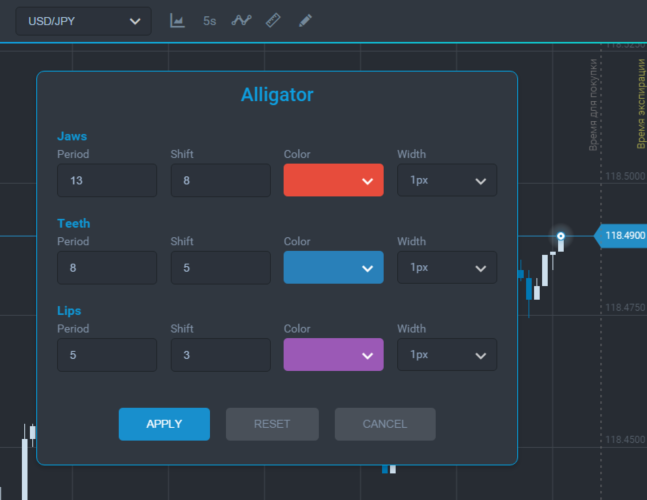

1) Add the alligator indicator to the chart.

Add an indicator

Indicator settings

2) Wait when the price chart has crossed the slowest indicator line — the jar (a red line on the picture).

3) After the closing of the mouth (a fast line of lips crosses a slow jar line) buy an option in the opposite direction from the jar line.

A signal about the end of bullish tendency — the alligator closes its mouth and you can buy a put

Advanced use of the alligator indicator

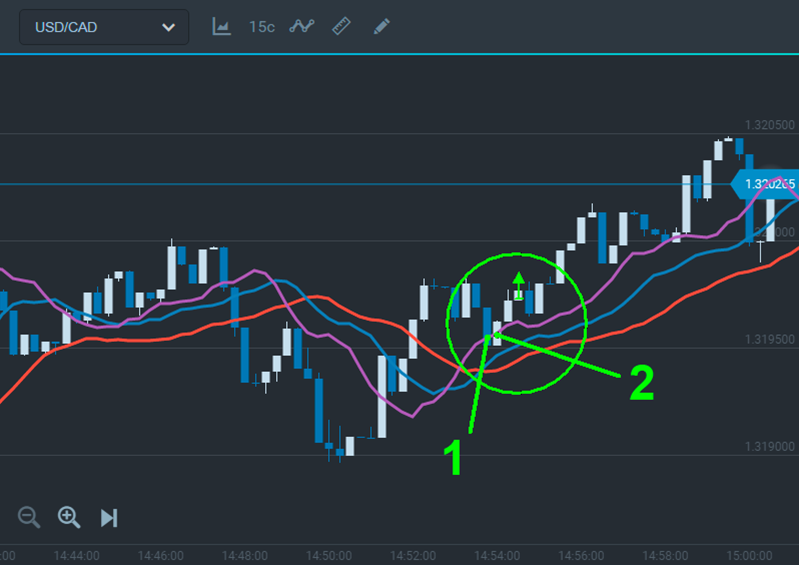

The lines of the alligator can function as either support or resistance. When the price reaches the fast lips line (depicted as a violet line in the image), it signals an opportunity for bounce trading. To validate this signal, it's essential to confirm that the jar line has been broken out.

What to do:

1) If a candlestick closes at the alligator’s lips line or outside we can wait for a signal appearance.

2) A signal occurs when a candlestick forms in the opposite direction of the indicator lines. A particularly robust signal is present if a candlestick closes before reaching the lips line.

3) We trade online in the bounce direction after a confirmation: the following candlestick closes in the same direction.

A signal to buy a call after the alligator’s lips bounce